Newsletter

27 June 2024

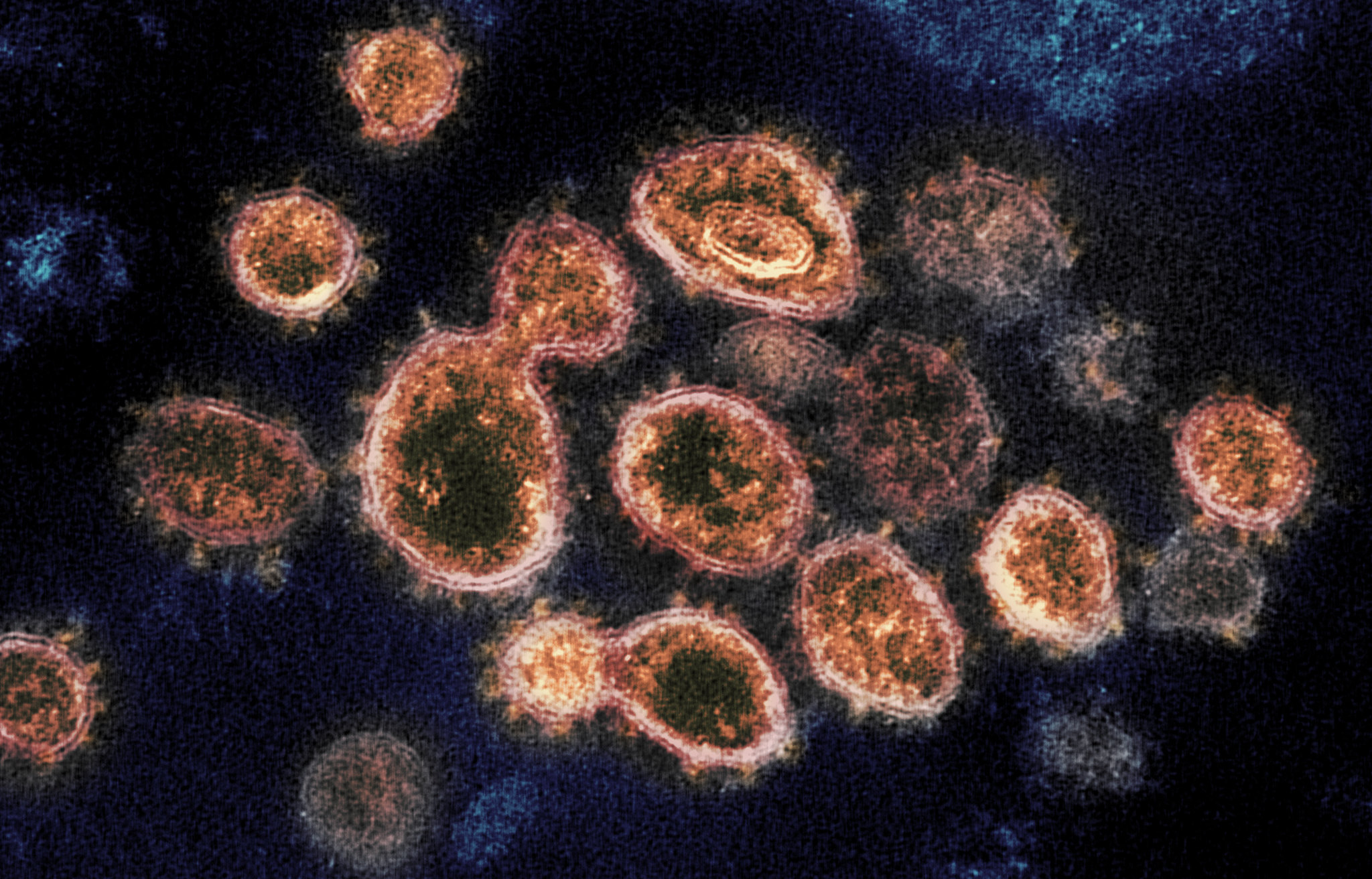

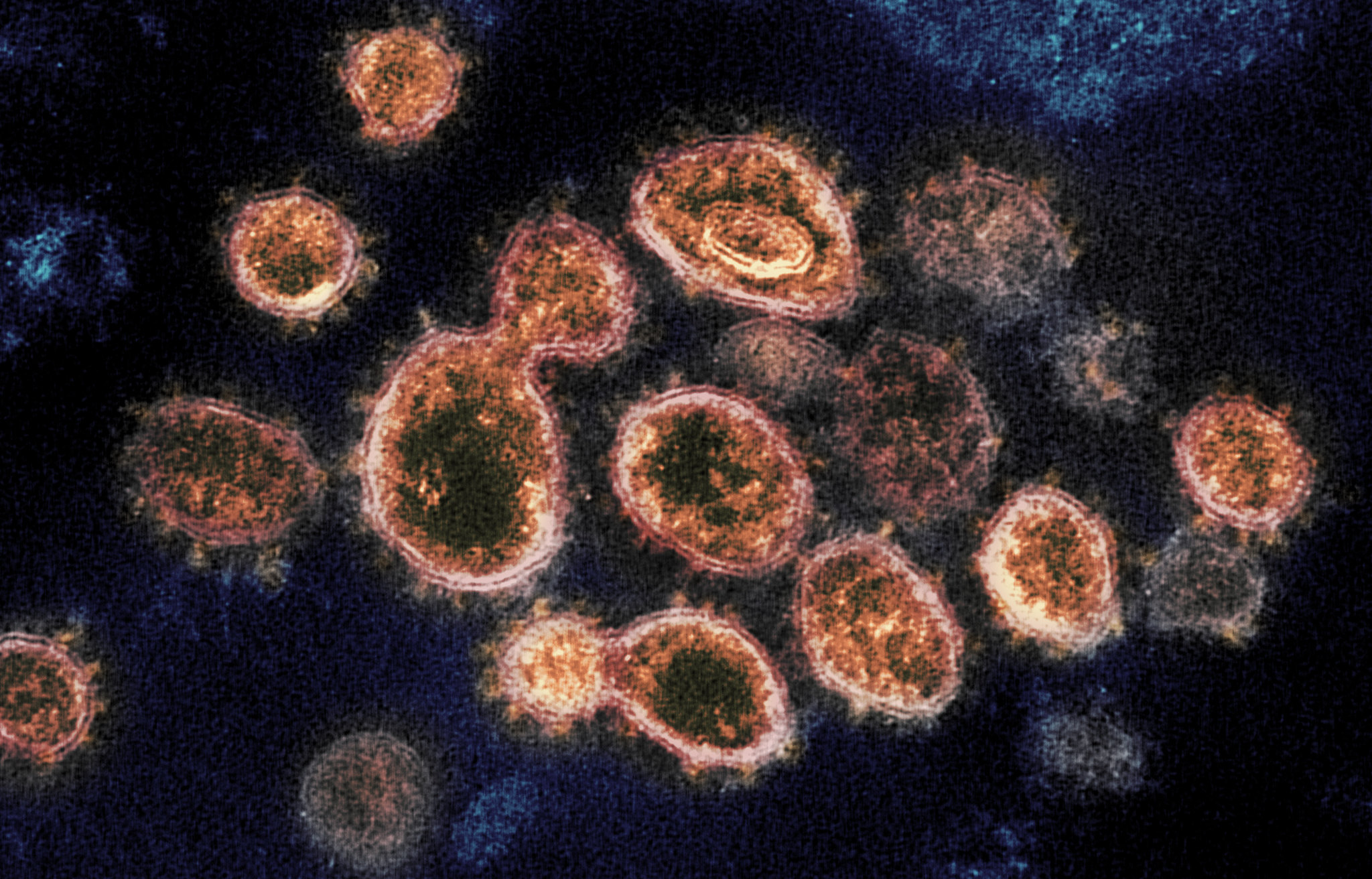

Corona Virus Outbreak: Infecting Trade in Indonesia

The Indonesian trade sector has been highly infected by the massive Coronavirus outbreak. Now, it is a question of how far this virus would affect Indonesia in the long run.

| Felicia Komala, Rininta Ayunina

Currently, the global economy is considered to be unfriendly due to the spread of the coronavirus (“COVID-19”). With China ranking as the world’s top trader, the massive outbreak of the virus is inevitably halting much of its activities with other states because of the fear of such virus being transmitted.[1] Consequently, this alarming situation has lead to several states being increasingly worried about its impact on international trade. Indonesia is no exception.

As of late February, 2020, there have as yet been no cases of COVID-19 contracted in Indonesia. Despite hosting approximately 5,000 Chinese tourists a day in Bali alone, no COVID-19 is presently known to have infected anyone in Indonesia.[2] Seemingly this supports the circulating rumor that Indonesians are somehow immune to the virus. Unfortunately, this notion of immunity does not extend to Indonesia’s trade condition, even if it turns out to be true on a personal level, which seems doubtful.

Impact on Indonesia’s Economy

To minimize the spread of COVID-19 to Indonesia, the government has enacted travel restrictions on people traveling from, to and through China. Though such measure is understandably necessary, given the rising number of reported cases of COVID-19 worldwide, these restrictions are expected to cost Indonesia something in the range of US $ 4 million, seeing that Chinese tourists account for an average of 13% of overall foreign tourist visits.[3]

In response to the development of this issue, the Minister of Trade issued a regulation on the temporary ban on imports of live animals from China, i.e. Regulation No. 10 of 2020. This entails the prohibition against live animals that either originate from or transit through China from entering Indonesian territory. This ban worries food and drink manufacturers, as limited supply would cause a significant surge in price.[4] Such uneasiness is based upon the fact that China plays an important role in Indonesia’s trade. As Indonesia’s biggest trading partner and major export destination, China trade amounted to US $ 28 billion in exports and US $ 44.9 billion in imports during 2019 alone.[5] It is not easy for Indonesia to find a replacement in supplies in such short notice, particularly of products of the same quality and competitive prices.

Without question, the trade of other commodities, such as the export of crude palm oil, coal and other minerals, are also affected. With COVID-19 affecting thousands of people in China, there is not much business activity being conducted. Thereby, this depletes the demand for crude palm oil and minerals that would otherwise be essential for businesses in China. Considering that China consumes a large portion of crude palm oil and minerals produced in Indonesia, the Chairman of the Indonesian Employers Association has stated that with the current rate, Indonesia would not be able to meet their current 5.3% economic growth target.[6] In relation to this, other imports from China have also slowed down in meeting Indonesia’s demands.

Considering all the existing measures taken by Indonesia, China has stated that Indonesia is simply overreacting, claiming that the measures are extreme and can only cause a negative impact on the economy, investment, and even China-Indonesia relations. Seeing its recent imposition, its negative impact has not as yet materialized, though it is highly expected to mirror the falling rates in tourism.

Impact on Contracts Performance

Reducing business performance would not only affect the economy as a whole, but also prove to be burdensome for businessman. If the COVID-19 has rendered performance impossible to be completed, perhaps due to government-imposed restriction on trade or travel bans, it is often the case that the party owing such performance is exempted.[7] This circumstance is referred to as Force Majeure. In private contracts, it is only reasonable to determine exemption from performance based on whether such exemption is afforded under the parties’ contract. Depending upon the extent of the case, the performing party is normally partially or wholly excused from liability. Therefore, a performing party may be exempted from performance, based upon the effect of COVID-19.

In cases where the contract does not explicitly cover this matter, the governing law should be applied. Article 1244 of the Indonesian Civil Code stipulates the requirements for exemption, which are: un-foreseeability and unavoidability. Foreseeability is found when there is a “reasonable possibility” that a certain impediment may occur.[8] Avoidability refers to whether the performing party could have taken steps to avoid the impediment. To be exempted under the Indonesian Civil Code, both these elements must be fulfilled by the existence of COVID-19. In other words, the performance must be made impossible by COVID-19 – which is unforeseeable and unavoidable by the performing party.

In some extreme cases, it is possible for performance not to be impossible, but to be made excessively difficult or onerous to be performed. Hypothetically, this is when performance becomes too expensive to be performed and would destroy or diminish the initial financial purpose of the contract. Under Article 6.2.2 of the UNIDROIT Principles of International Commercial Contracts, this is a case of Hardship – where exemption of performance is afforded.

Thereby, COVID-19 will inevitably make performance within commercial transactions more difficult. Seeing the extent and reaction to COVID-19, business actors will most likely be protected from liability by the safety net of force majeure.

It is only hopeful that a cure for COVID-19 will surface shortly to restore balance in the global economy, including Indonesia’s economic and business activities.

[1] Mulyanto, Randy., Firdaus, Febriana., “Why Are There No Reported Cases of Coronavirus in Indonesia?”, 18 February 2020, accessible at: https://www.aljazeera.com/news/2020/02/reported-cases-coronavirus-indonesia-200218112232304.html

[2] Paddock, Richard C., Sijabat. Menra Dera., “Indonesia Has No Reported Coronavirus Cases. Is That the Whole Picture?”, 11 February 2020; see: https://www.nytimes.com/2020/02/11/world/asia/coronavirus-indonesia-bali.html

[3] Ibid.

[4] Zulfikar, Muhammad., Tarahita, Dikanaya., “Coronavirus Takes Its Toll on China-Indonesia Relations”, 15 February 2020, accessible at: https://thediplomat.com/2020/02/coronavirus-takes-its-toll-on-china-indonesia-relations/

[5] Unditu, Aloysius., Bloomberg, “Indonesia Fears Economic Hit After Banning Live Animal Imports From China Over Coronavirus Fears”, 8 February 2020, accessible at: https://www.scmp.com/news/asia/southeast-asia/article/3049582/indonesia-fears-economic-hit-after-banning-live-animal

[6] Ibid.

[7] Article 1245, Indonesian Civil Code

[8] International Chamber of Commerce Court of Arbitration Paris, ICC Case No. 7197 in 1992